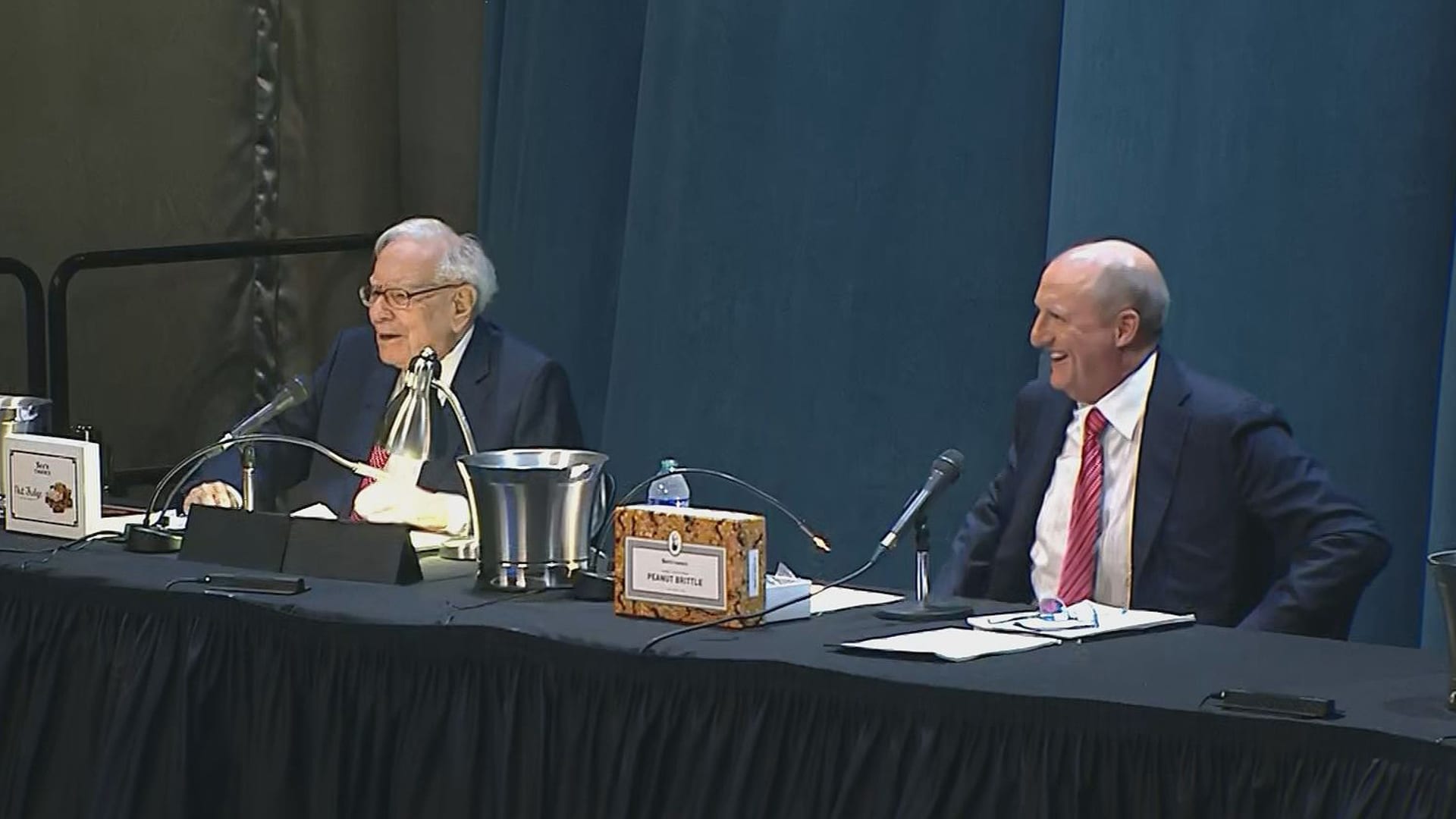

Warren Buffett and Greg Abel during the Berkshire Hathaway Annual Shareholders Meeting in Omaha, Nebraska on May 4, 2024.

CNBC

Warren Buffett has been mum about tariffs and the recent market turmoil, but will finally speak his mind when the 94-year-old investment legend kicks off Berkshire Hathaway‘s annual shareholder meeting on Saturday.

Tens of thousands of rapt shareholders will descend on Omaha, Nebraska this weekend for the annual gathering dubbed “Woodstock for Capitalists.” This year’s meeting marks the 60th anniversary of Buffett leading the company, and is the second without Buffett’s long-time partner Charlie Munger, who died in late 2023.

The biggest event in the Cornhusker State next to a Nebraska-Oklahoma football game, this year’s meeting comes as markets have turned uncertain after President Donald Trump’s aggressive rollout of the highest tariffs on imports in generations. (Many were suspended for 90 days afterward.) Wall Street economists left and right are sounding the alarms that a recession may be in the offing, as recent data pointed to signs of economic weakening.

“Because Berkshire owns so many businesses, they’re basically on the front lines of everything in terms of the economy falling off. Is it even worse than what the numbers are already showing?” said Steve Check, founder of Check Capital Management, which counts Berkshire as its largest holding. “I hope, more than anything, that he speaks out against the way tariffs have been done. Everyone is looking for what Warren Buffett has to say.”

Investors’ north star

The “Oracle of Omaha” may have already let his actions do the talking. Berkshire has sold more stock than it’s bought for nine straight quarters, dumping more than $134 billion worth in 2024. That was mainly due to reductions in Berkshire’s two largest equity holdings — Apple and Bank of America. As a result of the selling spree, by December Berkshire’s enormous pile of cash had grown to yet another record, at $334.2 billion.

The world is eager to hear if Buffett, the most famous advocate of value investing, used the April market meltdown to hunt for bargains and lay the groundwork for deals. Although Buffett doesn’t make predictions of short-term market direction, investors will listen closely for any signals of his continued confidence in the U.S. economy — despite the tariff shock.

“I think the big question on everyone’s mind is what will Warren do with the pile of cash that they are sitting on and, more specifically, when can it be deployed, as he can help investors gauge when the all clear sign is lit,” said David Wagner, a portfolio manager at Aptus Capital Advisors and a Berkshire shareholder. Many investors, he noted, “tend to view Warren as the north star.”

Buffett will make a few introductory remarks at 9am ET Saturday, followed by an hours-long question-and- answer panel. Buffett’s designated successor, Greg Abel, and Berkshire’s insurance chief, Ajit Jain, will join Buffett on stage in the morning, with Buffett and Abel alone in the afternoon. The Q&A session will be broadcast on CNBC and webcast in English and Mandarin.

Big Apple question

Shareholders are also curious for Buffett to explain his motivation in slashing his longtime Apple stake. After a head-turning selling spree for four quarters in a row, Berkshire’s Apple holding has stayed at an even 300 million shares since the end of September, leading many to speculate that Buffett is done selling the stock for the time being.

At last year’s annual meeting, Buffett suggested that the sale was for tax reasons following sizable gains. He also implied that selling down Apple could be tied to his wanting to avoid a higher tax bill in the future if rates went higher to fund the yawning U.S. fiscal deficit. With a change in government in Washington, shareholders want to hear Buffett’s reasoning today.

“You can’t use that explanation anymore because it clearly does not apply,” said David Kass, a finance professor at the University of Maryland. “If he sold more, it would indicate that he probably felt it was fully valued, or Warren Buffett being the genius that he is, he was able to see ahead at some of the risks that could face Apple, in case there’s a trade war and tariffs.”

Berkshire’s first-quarter earnings report, due Saturday morning, will show the conglomerate’s top equity holdings, which could give investors a hint as to whether the Apple stake was adjusted again.